Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

NOTE: Due to the start of daylight savings in parts of Australia, US markets now shut at 7 am AEDT, rather than 6 am, AEST.

MARKETS WRAP

- S&P 500 - 3678 (+2.59%)

- NASDAQ - 10815 (+2.27%)

- CBOE VIX - 30.18

- USD INDEX - 111.64

- US 10YR - 3.649%

- FTSE 100 - 6909 (+0.22%)

- STOXX 600 - 390.83 (+0.77%)

- UK 10YR - 3.959%

- GOLD - US$1702/oz

- WTI CRUDE - US$83.63/bbl (+5.2%)

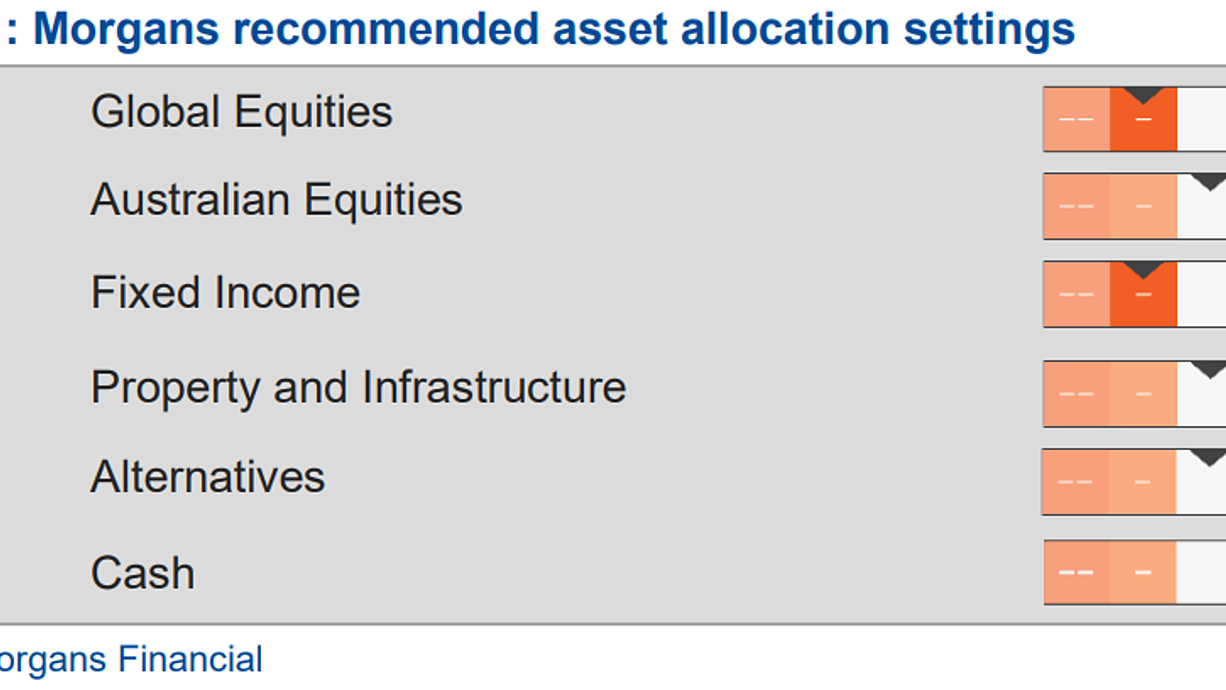

THE GRAPHIC

Today's graphic comes from Morgan's Asset Allocation update for Q4 2022. The supporting commentary that goes with the graphic highlights Morgan's preference for "assets with defensive characteristics, inflation protection and lower correlation to the economic cycle." The key takeaway is as follows; "investors are advised to be nimble with their cash holdings."

Morgans points to a relatively bleak economic outlook, although Australia should fare better than most given we are net exporters of raw materials. Other headlines include:

- The global economy is headed for a likely recession

- Most major central banks will press on with tightening due to uncomfortably high inflation

- Europe will succumb to recession amid higher energy prices and subsequent terms of trade shock

- China's economy will continue to struggle with a property slump, fading export demand, and limited policy support

- Energy commodity prices will remain high amid supply disruption and non-energy commodities don't have much further to fall

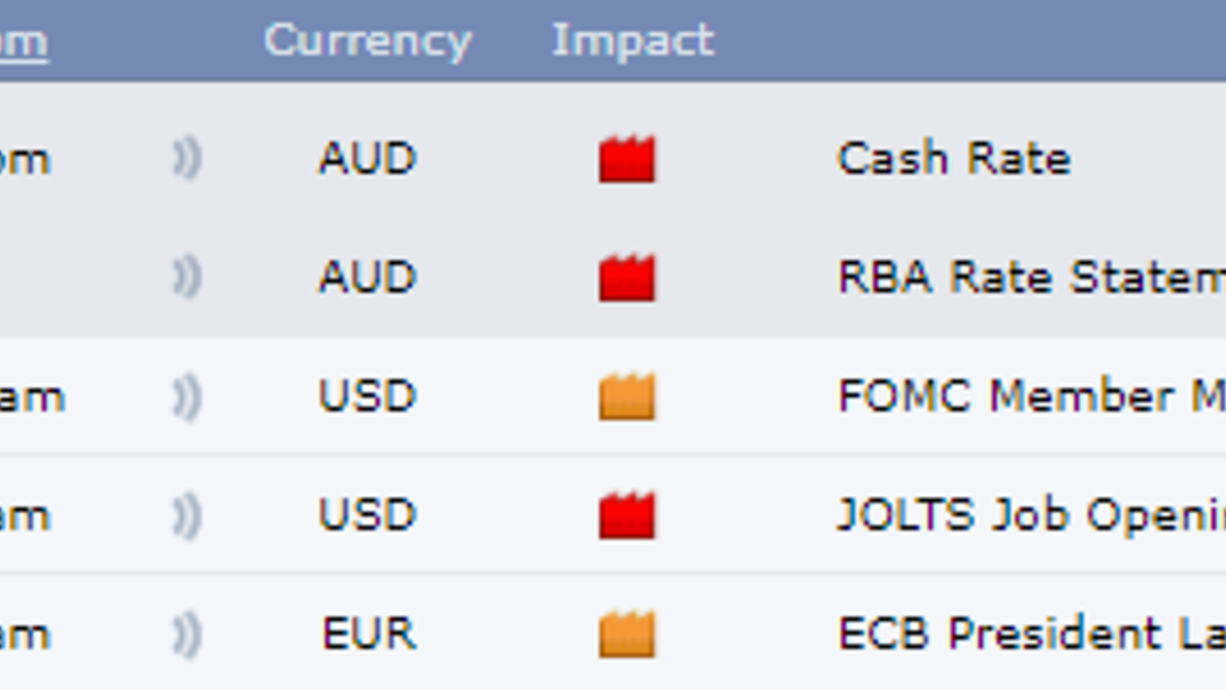

THE CALENDAR

It's all about the RBA decision today. The market is pricing in an 80% chance of a 50 basis point hike. If it comes to fruition, it would the sixth hike in as many months. Some economists believe that the central bank will only hike by 25 bps, particularly in light of the recent turmoil in international markets, in particular the surge in the price of the UK government debt.

STOCKS TO WATCH

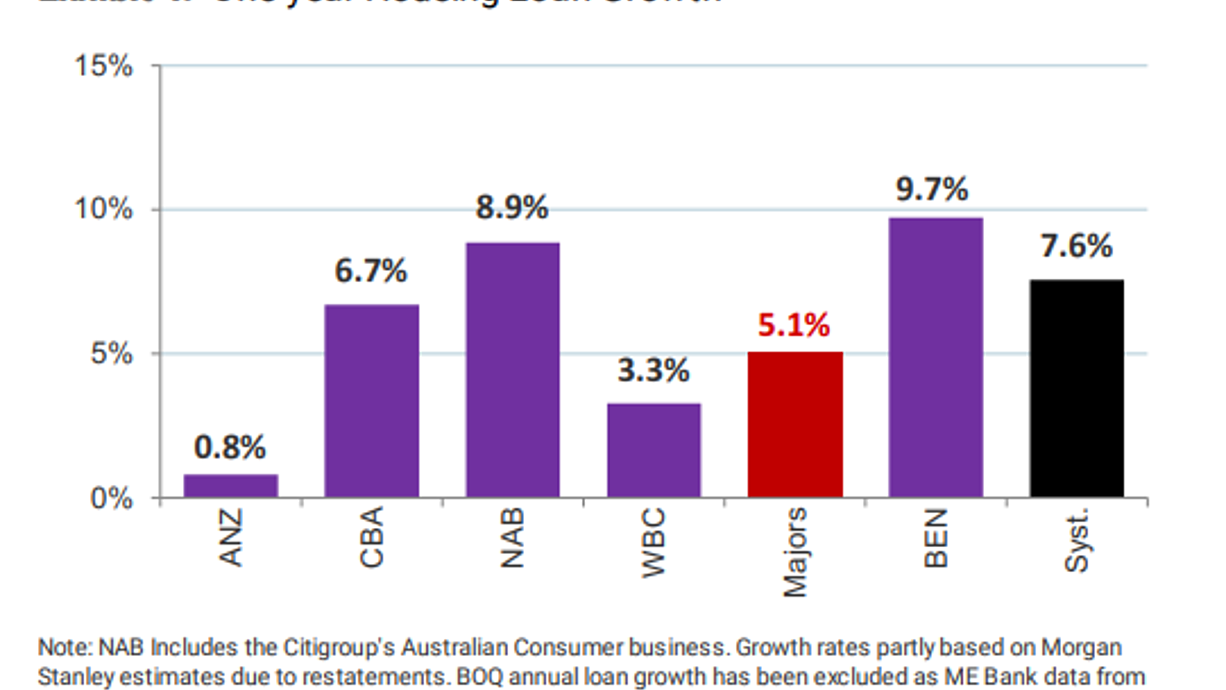

In short, the focus is on the banks - particularly ahead of today's RBA decision. A recent note from Macquarie notes slowing growth and competition has been partly offset by deposit tailwinds. Housing credit growth has continued to moderate whilst competition for mortgages remains intense. Retail deposit spreads continue to be highly lucrative, providing meaningful margin upside in the next six months.

Amongst the winners, National Australia Bank (ASX: NAB) and Westpac (ASX: WBC) have grown ahead of their peers, growing at around system. Commonwealth Bank (ASX: CBA) has grown at 0.7x system, whilst ANZ Banking Group (ASX: ANZ) continues to struggle to arrest its market share decline. Regionals are growing well below system.

THE CHART

Sticking with the banks, the chart above comes courtesy of Morgan Stanley and shows housing loan growth over the past year. Bedigo and Adelaide (ASX: BEN) has been growing above system over the period, although, as mentioned above, that is no longer the case. NAB is the only major to be above system, whilst ANZ is languishing badly over the past year.

Chris Conway wrote today's report. Hans is on leave.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content, and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

Dow jumps more than 750 points, local focus is on the banks ahead of the RBA - Livewire Markets

Read More

No comments:

Post a Comment