The BRICS (Brazil, Russia, India, China, South Africa) summit held this week in South Africa added six more member countries, but there are no signs of a digital currency. Instead there was a commitment to greater use of local currencies rather than dollars. This week, three other non-BRICS countries announced similar moves.

The big news from the event is the plan to add six new members by January 2024: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the UAE, creating an even more diverse group.

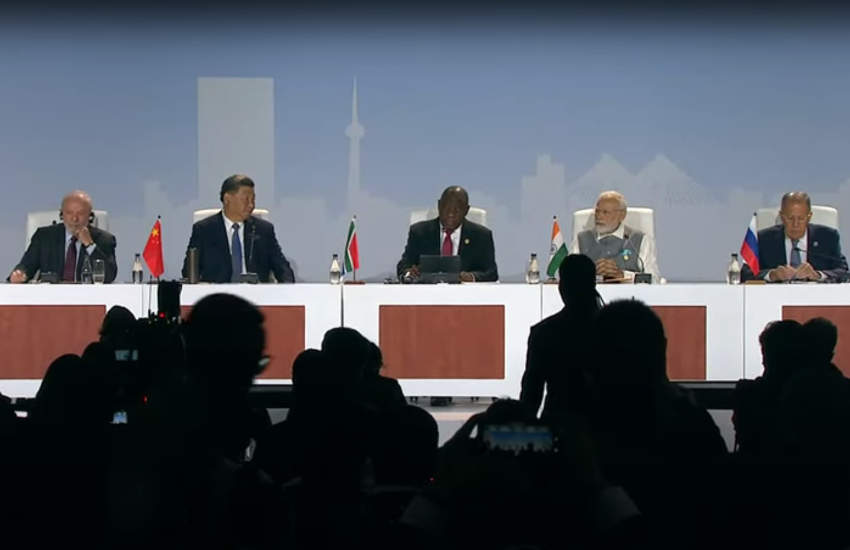

“We are concerned that global financial and payment systems are increasingly being used as instruments of geopolitical contestation,” said Cyril Ramaphosa, South Africa’s President. “Global economic recovery relies on predictable global payment systems and the smooth operating of banking, supply chains, trade, tourism as well as financial flows.”

The joint Johannesburg II declaration encouraged the use of local currencies for trade between BRICS countries and other trading partners.

It also stated, “We task our Finance Ministers and/or Central Bank Governors, as appropriate, to consider the issue of local currencies, payment instruments and platforms and report back to us by the next Summit.”

Regarding platforms, China and the UAE are already participating in the MBridge platform for cross border payments using digital currency in conjunction with the BIS. There have been rumors of Russia and Iran working on a digital currency collaboration.

Five nations (not all BRICS) announce local currency plans

In the last few days there have been multiple announcements about initiatives to use local currencies instead of the dollar for cross border trade. India and the UAE recently announced plans to work on cross border CBDC initiatives. In the meantime they are stepping up the use of local currencies.

Last week, the Abu Dhabi National Oil Company (ADNOC) and the Indian Oil Corporation Limited (IOCL) executed their first transaction for a million barrels of oil under the Local Currency Settlement (LCS) framework. This was described as reducing fees and accelerating settlement times by avoiding multi day delays with US dollars.

The Reserve Bank of India has encouraged banks to start using rupees and dirham for trades between the two countries, according to Reuters.

Beyond BRICS, today the central banks of Indonesia, Malaysia, Thailand also announced agreements to trade with each other in local currencies. However, they previously signed similar agreements in 2015.

BRICS pivots from digital currency to local currency. Non-BRICS countries follow - Ledger Insights

Read More

No comments:

Post a Comment