It has been previously suggested that the comparatively slower rate of connectivity for much of the region has helped to power the trend, such that mobiles were the first online devices for the majority of the population and Asian tech companies could more readily concentrate on push-of-button convenience over a product-centric approach.

But now, Oliver Wyman says, the race to build equivalent cross-market dominant platforms is starting to accelerate in the West.

The firm gives the example of PayPal, which is in the process of adding a suite of new capabilities such as in-app shopping tools, a crypto exchange, and a savings account in its stated bid toward SuperApp status. Meta, too, can be seen to be increasingly blurring the boundaries between e-commerce, payments and entertainment via its social networking and messaging platforms.

Yet, companies in Australia have been less vocal about any such aspirations. Despite that, Oliver Wyman believes the local market now holds even greater SuperApp opportunity than that of North America and Europe, thanks to recent changes in Australia’s regulatory, consumer, data and technology landscape.

The consulting firm in particular points to the introduction and ongoing roll-out of the government’s open data Consumer Data Right (CDR) legislation, which it describes as a “SuperApp accelerator”.

Complementing what is an already advanced, wealthy market with a high level of digital services penetration and increasingly savvy consumer-base, the CDR grants consumers control over how their data can be securely accessed and shared through digital channels, with the aim of promoting greater competition and product and service innovation among a number of traditional sectors – starting with banking and soon energy and telecommunications.

SuperApps in financial services

Oliver Wyman says that major financial institutions are already beginning to look at how this new data environment can streamline existing services and operations, and even transform the way in which products are provided. It adds; “With the extension to different industry sectors, the barriers between data collection and service provision cross sector could be materially reduced, opening the door for integrated solutions and the rapid emergence of a SuperApp capability.”

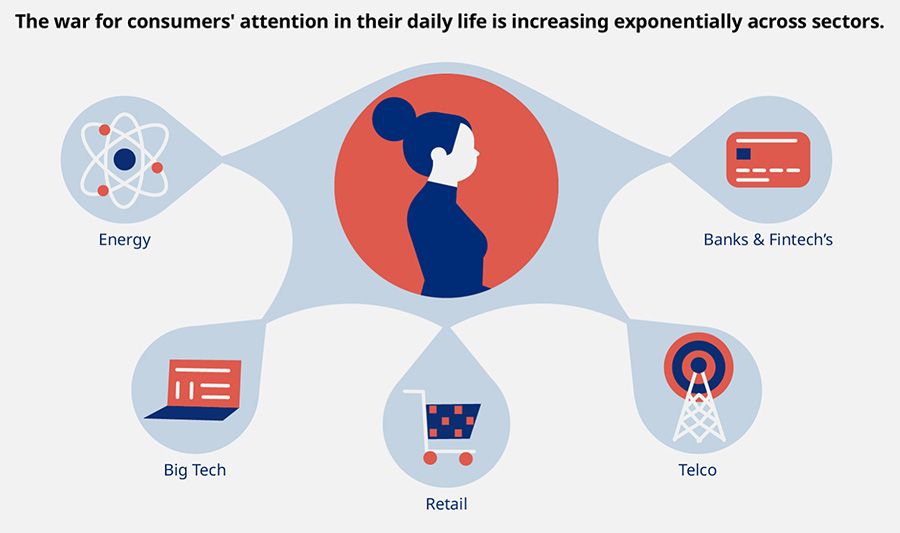

As such, the consultancy expects that big tech seeking to grow through their payment services will emerge as the local SuperApp front-runners, along with major banking, teleco, and energy players aiming to consolidate their role as a one-stop shop for consumer utilities.

Meanwhile, innovative startups will also be in on the chase, hoping to get a jump on the former through a consolidated services interface via which specialist providers can distribute their services at scale.

“While there are many paths to viability, we think one likely route for the Australian SuperApp will be servicing major life moments in a customer’s lifecycle,” say the authors. “On this pathway, the successful SuperApp in Australia would start by consolidating the customer’s data from their multiple services and products in one place. Once this view is provided, the next step would be to allow customers to compare these services to ‘customers like you’.”

Oliver Wyman envisions that once this detailed cross-sector digital transaction data and in-depth comparison capability was in place based on specific consumption habits, instant switching could then be enabled through API interfaces to service providers to facilitate real time quotes, applications and service activation in an already authenticated environment. “This would allow customers to move to better deals with a click of a button, all within the SuperApp.”

Finally, the proposed app could bundle packages of services targeting key life moments where a consumer might be inclined to switch providers, from a first job through to retirement.

In a banking SuperApp scenario, Oliver Wyman suggests a user’s new house and mortgage could come fully loaded with an energy plan, telecommunications bundle, and home & contents insurance, uniquely tailored to that person’s circumstances and provided through the app based on “customers like you”.

Should the first SuperApp unfold in this manner, the hypothetical bank would own the consumer relationship, and all other services become pass through utilities, continuously reviewed to allow “one click” switching based on shifting life requirements or service updates – with Oliver Wyman concluding that there will be significant implications and new risks and opportunities to the financial services, telecom and energy landscape as SuperApps emerge in Australia.

Will Australia soon see the emergence of a local SuperApp? - Consultancy.com.au

Read More

No comments:

Post a Comment